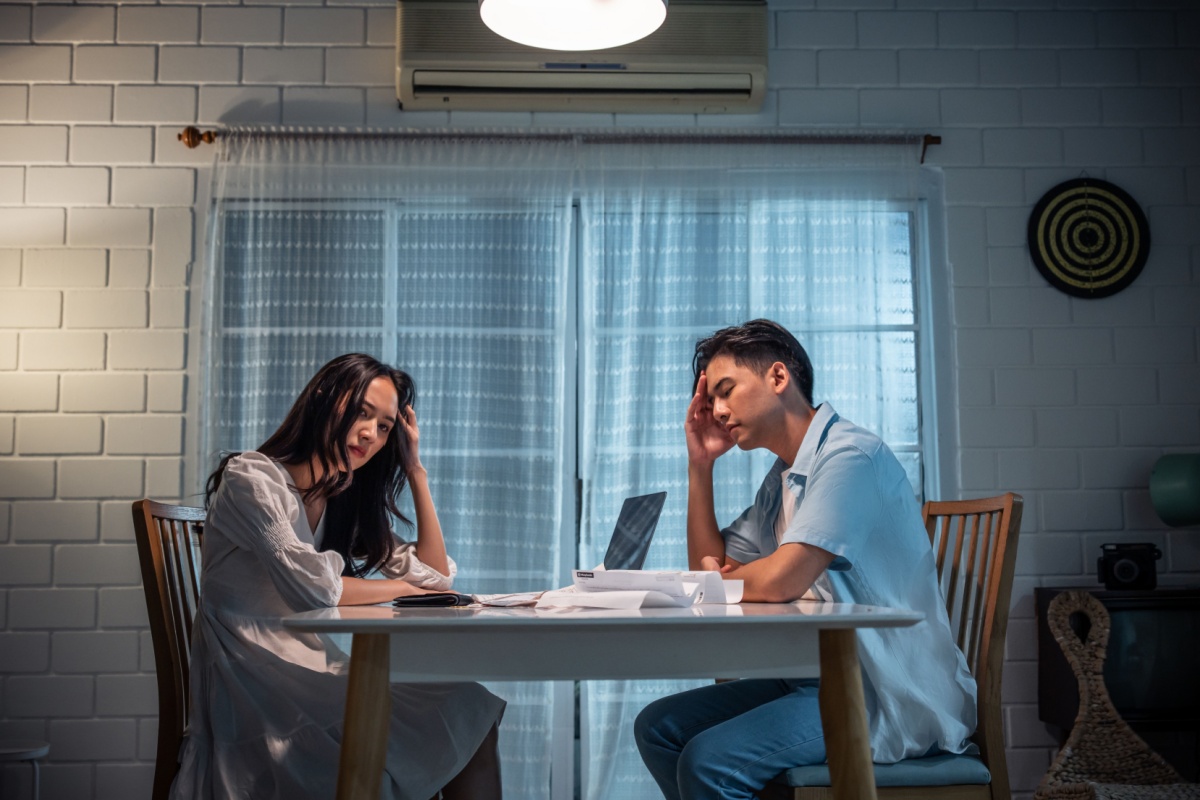

Learn how to navigate these delicate issues without damaging your most important relationships

Money can be a tricky subject, especially when it comes to family. Whether it’s a loan that never got paid back, one child receiving more financial support than another, or the unspoken expectations around inheritance, money has a way of creating tension and resentment among even the closest relatives.

While financial matters can be difficult, we’ve come up with five tips for navigating money resentment with your family. After all, family is worth far more than any dollar amount.

1. Acknowledge the Emotional Weight

Money isn’t just numbers and bank balances—it’s tied to our emotions, values, and sense of fairness. When financial decisions seem unjust, it often triggers feelings of resentment, anger, or disappointment. The first step to resolving money issues in the family is acknowledging that emotions are involved. Ignoring the emotional weight behind money will only deepen resentment.

It’s also essential to check in with your own feelings. Are you feeling overlooked, or are you carrying the burden of past financial mistakes? Understanding your emotional triggers helps you enter these conversations with more empathy and self-awareness.

2. Open Up the Dialogue

Silence can be dangerous when it comes to money and family. If loans have gone unpaid, or one sibling feels financially favoured, it’s critical to have an open conversation. These discussions are never easy, but leaving them unaddressed often leads to bigger problems later on.

When you start the conversation, focus on clarity rather than blame. For example, instead of saying, “You never paid me back,” try, “I’ve noticed the loan hasn’t been repaid, and I’d like to discuss how we can resolve this.” Shifting the focus from accusation to resolution can make the discussion more productive.

3. Be Clear on Boundaries and Expectations

Family dynamics around money can become messy when boundaries aren’t clearly set. Whether you’re lending money or giving financial gifts, everyone involved should understand the expectations from the start. Will a loan be repaid within a certain time frame, or is it a gift? If you’re helping one child more financially, have you explained why?

Clear communication up front avoids misunderstandings later. If things feel unbalanced, it may help to have a family meeting where everyone can share their concerns and perspectives. Transparency is key.

4. Address Feelings of Resentment Directly

Resentment around money doesn’t go away on its own. If you or another family member feels slighted, it’s important to acknowledge it. This doesn’t mean immediately asking for money back or levelling accusations, but rather expressing your feelings calmly and constructively. For example, “I’ve been feeling frustrated about how money has been handled between us, and I’d like to work through this together.”

Sometimes, working through these feelings may require professional help, like a family mediator or counsellor, to guide the conversation in a neutral and constructive way.

5. Seek Professional Guidance When Necessary

In situations where money and family issues feel too complicated or emotional to resolve on your own, seeking outside help may be the best course. Whether it’s a financial adviser to structure loans and gifts more fairly or a family therapist to help navigate emotional conflicts, professional guidance can provide clarity and resolution.

And when planning for the next stage of your life, here are the Five Money Tips Things to Consider Before You Retiring. And learn if you should get insurance through your superannuation fund here.